The Asia-Pacific (APAC) region is one of the world’s fastest-growing food markets, driven by shifting consumer behaviours, rapid urbanisation, wellness awareness, and rising disposable incomes. According to the latest NielsenIQ Dining into the APAC Food Trends report (2023–2025 update), three core themes are shaping how consumers shop, cook, eat, and dine: Simple Solutions, Personal Excitements, and Sustainable Consumption.

This article explores these themes in depth and highlights what they mean for FMCG brands, F&B operators, retailers, and food manufacturers across the region.

FMCG value in APAC grew by 4% for the year ending June 2025, propelled by 2.8% volume growth and a modest 1.2% price increase.

1. Simple Solutions

With the rise of remote work, individuals find themselves spending more time at home. This has also led to a shift in their dietary preferences, meal choices, and shopping behaviors.

Asia Pacific frozen food market (including ready-to-eat/frozen meals, bakery, desserts, vegetables, and seafood) is valued at USD 66.38 billion in 2024 and expected to reach USD 109.88 billion by 2030.

Consumers continue to value the convenience of frozen foods, especially those that require minimal preparation. Quick and easy-to-make frozen meal kits, instant noodles, and ready-to-eat options are popular.

2. Personal Excitements

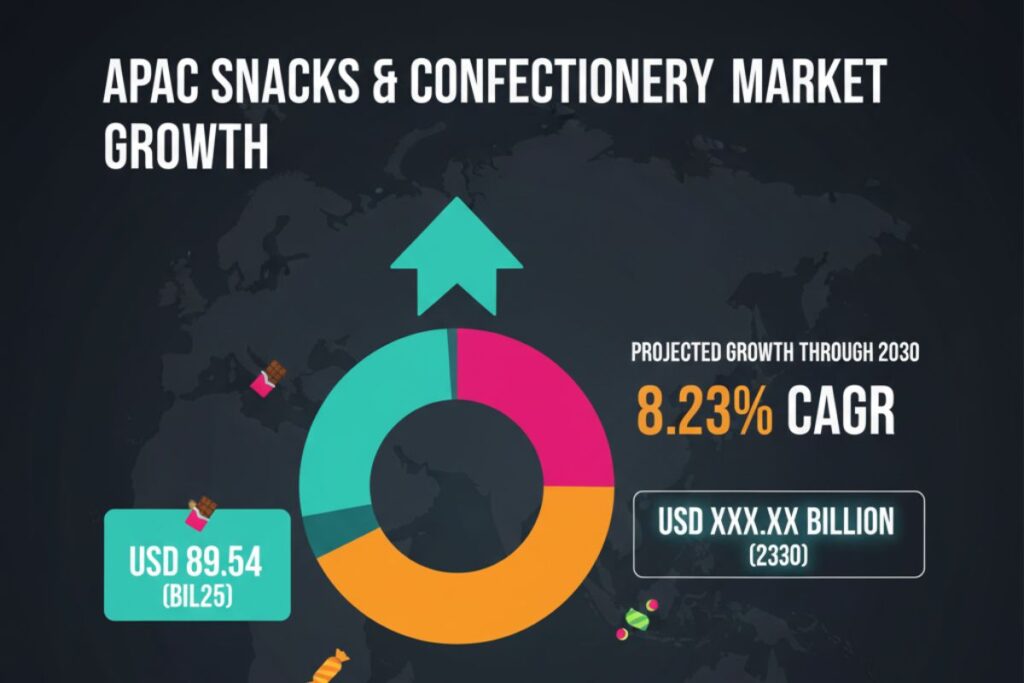

The updated market size for snacks and confectionery in the Asia Pacific (APAC) region is USD 89.54 billion in 2025, marking substantial growth from previous years and representing an annual growth rate of 8.23% projected through 2030.

The snacks and confectionery sector will be driven by the following factors:

Premium selection

Analysts see a growth in the premium snacks and confectionery sector, targeted at consumers seeking high-quality ingredients, unique flavours and limited edition releases. The use of high-quality, premium ingredients is a hallmark of this sector. Brands focus on sourcing ingredients with superior flavour profiles and nutritional value, such as single-origin chocolates, exotic fruits, and gourmet nuts.

Conscious eating

Consumers are increasingly looking for snacks and confectionery items that align with their health and wellness goals. This has led to a rise in products with reduced sugar, lower sodium, healthier fats, and natural ingredients. Brands are incorporating functional ingredients like nuts, seeds, and dried fruits to offer more nutritional value.

37% of APAC consumers say there are more likely to buy a brand based on nutritional benefits. Having transparent labelling that clearly communicates ingredients and their sources will help to appeal to consumers. Clean label snacks and confectionery items that have simple, recognizable ingredients are gaining popularity.

Functional snacking

Snacks that offer functional benefits beyond satisfying hunger are gaining traction. These include snacks enriched with vitamins, minerals, antioxidants, and other health-promoting components.

3. Sustainable Consumption

Sustainable consumption trends reflect the growing awareness and concern for environmental, social, and ethical issues related to consumer choices.

Sustainable eating: Plant-based alternatives

Growing concerns about animal welfare and environmental impact have led to a rise in plant-based and sustainable diets. Consumers are reducing their meat and dairy consumption, opting for plant-based alternatives, and seeking out sustainably sourced seafood.

Sustainable packaging

Most food packaging is designed to be single-use and they are typically thrown away rather than reused or recycled. Increasing awareness of the environmental impact of packaging waste, such as plastic pollution in oceans and landfills, has prompted a sense of urgency to address the issue. Consumers are demanding more sustainable packaging solutions to reduce waste.

45% of consumers say they will buy more recycled packaging in the next 6-12 months. Large FMCG companies are stepping up their sustainability initiatives. Consumers are increasingly making purchasing decisions based on sustainability considerations. Brands that offer environmentally friendly packaging are more likely to attract and retain customers who prioritise responsible consumption.

More FMCG insights: From premiumization to in-home delights, exploring Hong Kong’s dynamic FMCG consumer trends – NIQ (nielseniq.com)

This article was contributed by Nielsen IQ.

Cover Photo by Tim Cooper on Unsplash

Looking to expand your business into the Asian market?

FHA – Food and Beverage returns next year on 21-24 April 2026 at Singapore Expo. With a line-up of leading global suppliers, industry professionals can anticipate the most extensive showcase of trending F&B and hospitality products and solutions, cutting-edge technologies for food & drinks manufacturing, and more at the mega event. Contact us to get involved.

FAQ’s

What are the top APAC food trends in 2025?

The top trends include frozen meal convenience, premium snacking, healthier ingredients, plant-based alternatives, and sustainable packaging.

Why is the frozen food category growing so fast in APAC?

Busy lifestyles, remote work, improved frozen food quality, and demand for quick-preparation meals are driving growth.

What is driving premium snack demand in Asia?

Consumers are looking for indulgence, new flavours, authentic ingredients, and higher-quality experiences.

Why are plant-based foods increasing in APAC?

Rising environmental awareness, health concerns, and affordable alternatives are making plant-based options mainstream.

How can FMCG brands leverage these trends?

Brands can innovate with healthier ingredients, sustainable packaging, premium flavours, and convenience-focused product formats.

Conclusion

The APAC region is undergoing a major transformation in how consumers eat, shop, and enjoy food. Simple Solutions, Personal Excitements, and Sustainable Consumption will continue shaping the landscape through 2030. For brands and F&B operators, the greatest opportunities lie in convenience-driven products, premium experiences, and sustainability-focused innovations. Businesses that respond quickly to these rising preferences will be best positioned to capture APAC’s fast-growing and dynamic food market.